Great Lakes Mortgage Financial

Great Lakes Mortgage Financial (GLMF)provides a simple and accurate mortgage app, allowing you to perform mortgage calculations easily. Now you also have a document scanner at your disposal as well.

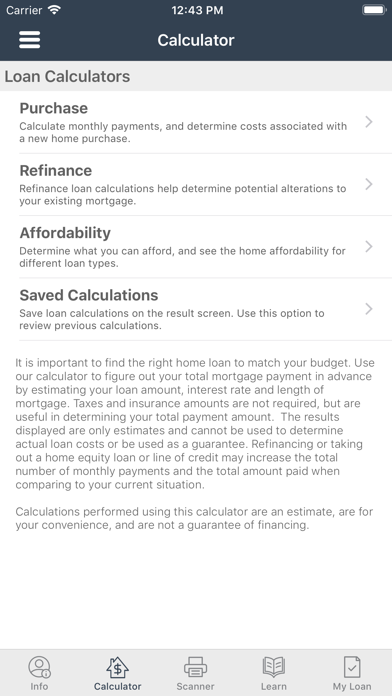

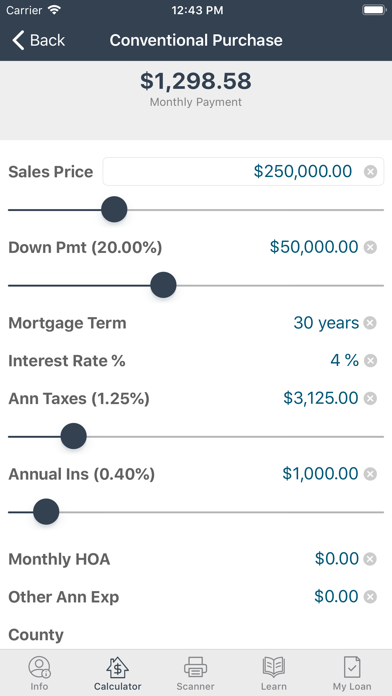

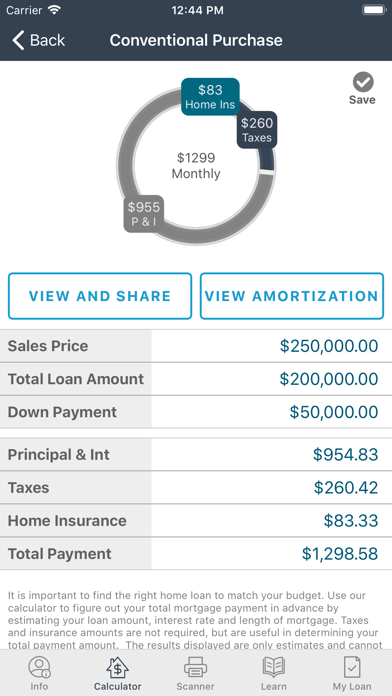

The calculator is quick and easy to use. Use the app to calculate New Home or Refinance FHA, Conventional, Jumbo, Rural, and VA loans. Affordability calculations can be done to determine what size of loan works for you. Enter a few parameters such as the sales price, insurance and tax amounts, and Great Lakes Mortgage Financial will calculate your monthly payments. It handles all the details of calculating necessary MI and required down payment amounts by understanding the loan type you are looking to perform. When you are done with your mortgage loan calculation, save the quote for later or contact a qualified mortgage broker right from inside the app! The GLMF Calculator Features:

- 5 Loan Type Calculators: FHA, Conventional, Jumbo, Rural, and VA

- Calculate New Home or Refinance

- Accurate, yet Simple, Calculations Using Latest Regulations for MI

- Save Your Loan Quotes for later viewing

- Easy to Contact a Local Mortgage Broker

Even if you are a home owner looking for a new mortgage loan or a Realtor looking for an easy to use mortgage app, youll love the Great Lakes Mortgage Financial Calculator. Mortgage Brokers and Loan Officers love it because its easy to offer their realtor associates and home buyers a branded, virtual business card - with mortgage calculations and document scanning.

Disclaimer: It is important to find the right home loan to match your budget. Use our calculator to figure out your total mortgage payment in advance by estimating your loan amount, interest rate and length of mortgage. Taxes and insurance amounts are not required, but are useful in determining your total payment amount. The results displayed are only estimates and cannot be used to determine actual loan costs or be used as a guarantee. Refinancing or taking out a home equity loan or line of credit may increase the total number of monthly payments and the total amount paid when comparing to your current situation.